June 1, 2015

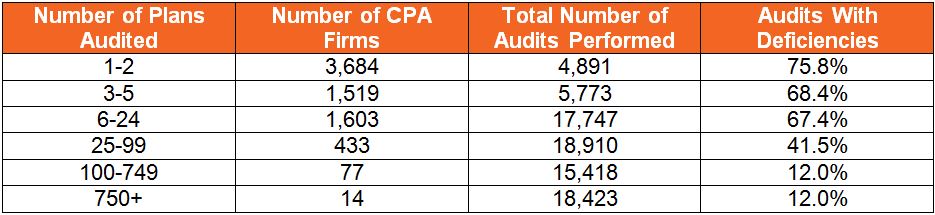

Last week, the U.S. Department of Labor (DOL) released a startling study entitled Assessing the Quality of Employee Benefit Plan Audits. The study surveyed Form 5500 filings and related audit reports for the 2011 filing year and included a sample of 400 plan audits from a target population of over 80,000 filings. CPA firms were divided into six strata based on the number of plan audits each firm performed. The following table summarizes the characteristics of each stratum and the results of the study by stratum.

CPA Firms Performing Plan Audits

The report is a wake-up call for CPAs performing employee benefit plan audits. Deficiencies were identified in more than two out of every three audits issued by firms performing fewer than 25 plan audits annually (more than 90 percent of the DOL’s sample).

The study demonstrates a strong link between the size of an employee benefit plan audit practice and audit quality. The data reveal a pronounced inverse correlation between the number of plan audits performed annually by a firm and the percentage of those audits that have deficiencies. That is, firms that perform more plan audits annually have fewer deficient audits.

Compared with previous studies, the DOL wrote that the findings reflected “an increase in the amount of plan assets and number of participants at risk”. Given an overall deficiency rate of 39 percent, the DOL estimated that deficient audits put approximately “$653 billion dollars and 22.5 million plan participants and beneficiaries at risk”.

The DOL is actively seeking legislative change in a bid for more regulatory authority, including the ability to register plan auditors and to suspend, debar, and penalize those performing substandard audits. The report recommends targeting future investigations on smaller plan audit practices and those in the 25-99 plan audit range. It also recommends directly informing plan sponsors who have engaged firms in the 1-2 and 3-5 strata of the results of the study.

Members of the CPA community must commit to more training and better quality plan audits or exit the plan audit business. The heat on plan auditors is expected to increase as the DOL continues to reject filings for substandard work. DOL referrals to the AICPA Ethics Division and state boards of accountancy appear to be on the rise.

Plan fiduciaries should exercise caution and prudence in hiring a plan auditor by making sure an existing relationship or a low cost doesn’t get in the way of specialized knowledge, experience and quality. For help in making an informed decision, plan sponsors should consider the AICPA’s guide Hiring a Quality Auditor to Perform Your Employee Benefit Plan Audit.

John Russon, CPA

jrusson@pensionassurance.com

805 277 7641

Pension Assurance LLP is a specialized CPA firm dedicated firm-wide and year-round to the audits of employee benefit plans. The firm performs over 150 benefit plan audits a year.