Five Ways an ERISA-specialist CPA Can Help PPPs Set Up or Improve Their PEPs

A competent auditor with a specialization in ERISA plan audits (“specialist CPA” going forward) can bring significant value to an audit client. But specialist CPAs can bring similar value to a pooled plan provider (PPP) when setting up a new PEP. In this article, we identify just five ways a specialist CPA can add value […]

Plan Forfeitures, New IRS Rules, and Transition Relief

Forfeitures in a qualified retirement plan refer to the non-vested portion of employer contributions relinquished by employees when they leave a company before meeting the vesting requirements. These forfeited funds are retained within the plan itself rather than being returned to the employer directly or distributed to the departing employees. The use of forfeitures within […]

Pension Assurance Enters its Second Decade

This November, Pension Assurance is excited to celebrate its 10-year anniversary. P/A was founded in 2014 by John Russon and Nathan Johnston who were joined by six employees. The nascent firm’s initial headquarters were in a non-descript Class B office space adjacent to a bowling alley in Tarzana, California, a neighborhood in Los Angeles’s San […]

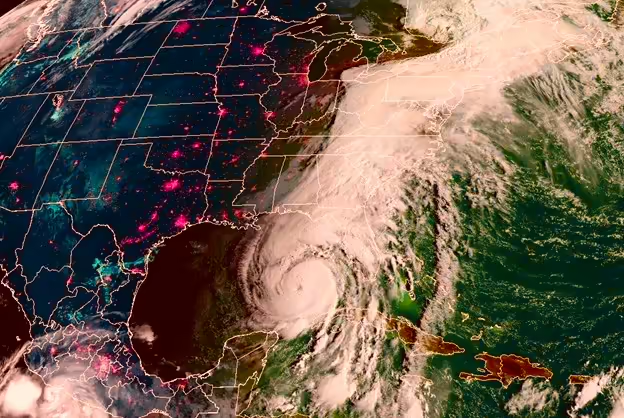

Tax Relief In Disaster Situations

Tax Relief Update: The IRS has issued disaster-related extensions for specific states and counties. Use this link to verify your eligibility for extended deadlines and available relief options today: https://www.irs.gov/newsroom/tax-relief-in-disaster-situations

Celebrating 50 Years Of ERISA

This Labor Day marks 50 years since the Employee Retirement Income Security Act of 1974 (ERISA) was signed into law by President Gerald Ford. The law passed in the House of Representatives 407 to 2 and in the Senate 85 to 0. The retirement landscape is significantly different now than it was when ERISA first […]